Dti car loan calculator

Multiply that by 100 to get a percentage. You can use your pay stubs to calculate this but be sure to use the pre-tax amount.

How To Calculate Debt To Income Ratio

Whats a Good DTI for a Car.

. Debt-to-income ratio or DTI is a financial measurement used by lenders when evaluating a loan application. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Thousand separators will be added automatically.

To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. Loan must be open for at least 60 days with. Back end ratio looks at your.

Ad Apply To Compare Rates From Multiple Lenders At LendingTree. Get Up to 5 Car Loan Offers With 1 Form. This is a self formatting text field.

Ad Choose from a Wide Variety of Makes and Models to Find the Perfect Car for You. To get the ratio as a percentage you. Auto refinance loan must be at least 5000.

Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb lenders are looking for a front ratio of 28 percent or less. Existing Navy Federal loans are not eligible for this offer. If they had no debt their ratio i.

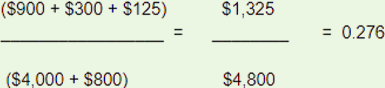

How to calculate your debt-to-income ratio. To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. 2500 5000 05.

VA guidelines on debt-to-income ratio requirements mandate a maximum debt-to-income ratio of 31 front-end and 43 back-end for borrowers with under 580 FICO and down to 500 credit. Using the values from the example above if the. Then divide the sum of your monthly payments by your gross monthly income to get your DTI.

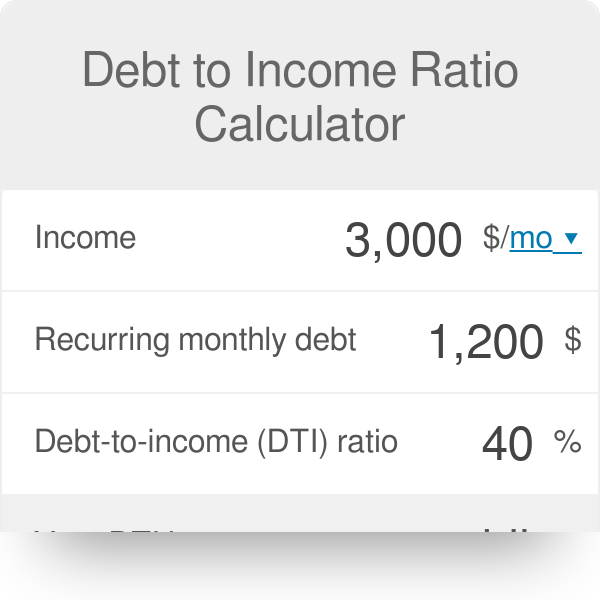

Determine your monthly gross income. Your monthly debt payments come to a total of 2000 which is then divided by your gross monthly income of 5000 which will then provide you with 40. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Credit and collateral subject to approval. If your monthly debts total 2500 and your gross monthly income is 5000 your DTI calculation would look like.

You will then see a percentage. DTI is a comparison of a borrowers monthly debt payments with monthly income. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided.

If you get paid weekly multiply that. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card.

What Is Debt To Income Ratio Truliant Explains

Debt To Income Ratio For Car Loans What To Know

Debt To Income Ratio Calculator

Debt To Income Dti Ratio Calculator Excel Templates

What Is Dti And How Does It Affect Your Mortgage Eligibility A D Mortgage Llc

Dti Mortgage Calculator Cheap Sale 58 Off Www Ingeniovirtual Com

Dti Mortgage Calculator Cheap Sale 58 Off Www Ingeniovirtual Com

Debt To Income Ratio Formula Calculator Excel Template

Dti Mortgage Calculator Cheap Sale 58 Off Www Ingeniovirtual Com

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Dti Calculator

What Is The Max Dti Ratio For A Car Loan Auto Credit Express

Auto Loan Calculator Calculate Car Loan Payments

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Dti Credit Com

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

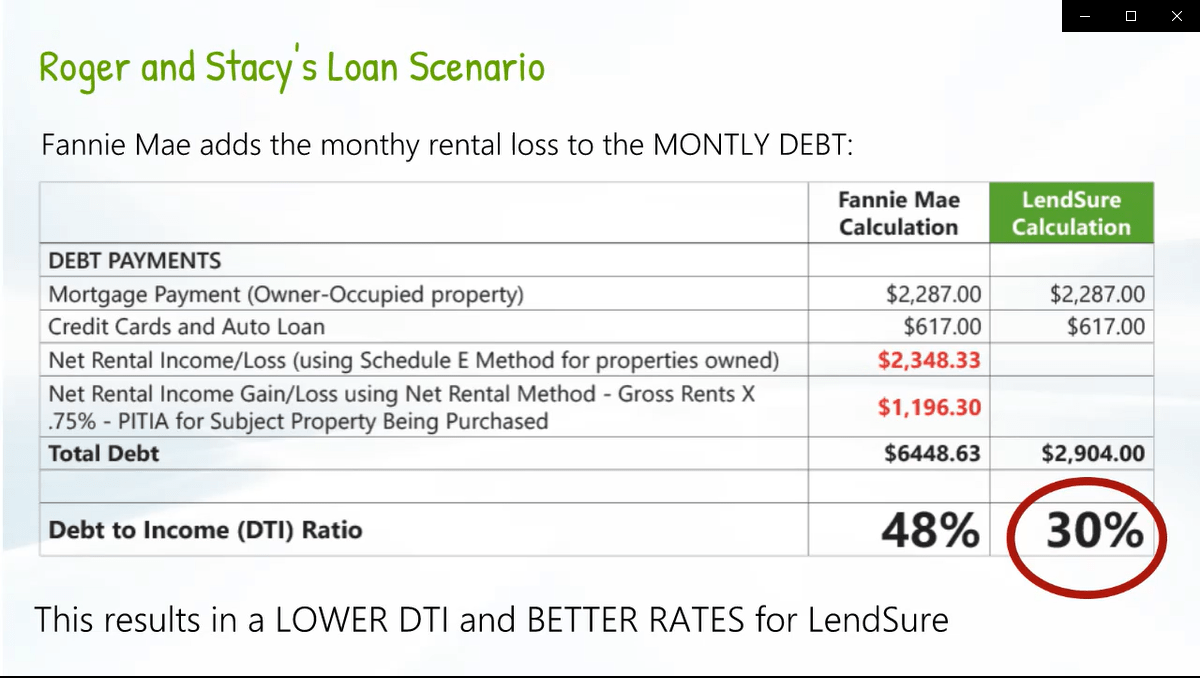

Rental Income Calculation For Better Dti Lendsure Mortgage Corp